The South Napa earthquake surprised and shocked residents two years ago this August. Here are 5 tips to help you and your clients be informed before the next earthquake strikes.

1. The damage is real and it costs more than you think

Just take a look at these alarming images of Napa streets and homes in complete disarray from the 2014 earthquake. Houses weren't simply red-tagged, many of them had received such significant damage, they were declared total losses.

2. Many can't live without financial support after a damaging earthquake

Make sure your clients are covered. Most of the people affected by the South Napa quake did not have any earthquake coverage, and FEMA assistance wasn't available for more than 60 days after the event struck. People were forced to pay out of pocket for ALE. Most families simply don't have enough of a buffer to get by and rent a temporary home or hotel for 60 days.

3. FEMA aid isn't meant to rebuild your client's home

So many of the agents and consumers we chat with think that FEMA assistance makes earthquake coverage a moot point. In fact, the average FEMA grant for the South Napa earthquake was less than $5,000–not nearly enough to rebuild a home, replace personal property, or live elsewhere for long while repairs are made.

Most importantly, these grants are not there to help your clients rebuild their home. They exist only to help make the home safe, secure, and sanitary–in other words, livable. There are also government loans, but, even if your clients qualify, it would need to be repaid with interest, just like a mortgage they are still responsible for paying.

4. Your clients have more choices and that's better for everyone

This year, we rolled out even more great policy choices to help your clients get the coverage they want and need, including:

- Personal property up to $200,000.

- More deductible options, ranging from 5% to 25%.

- Even more affordable rates -- 10% average statewide rate reduction.

- Optional endorsements for exterior masonry veneer and breakables.

5. Make sure your client has the right coverage

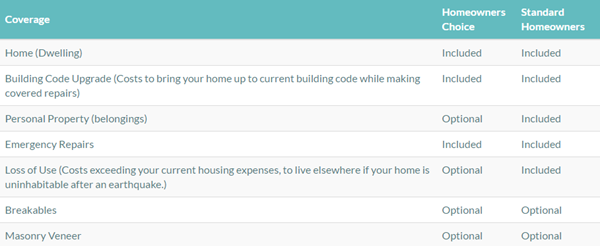

Many CEA policyholders have their homes insured under a standard Homeowners policy, which pays, up to the policy limit, to rebuild a home and replace personal property when the covered dwelling damage exceeds the dwelling deductible.

Our Homeowners Choice policy, on the other hand, has a separate dwelling and personal property deductible, allowing personal property damage to be paid even if the dwelling damage is less than the deductible. So, earthquake damage that would not normally be paid under our standard policy may be paid under the Choice policy in the event of a moderate earthquake.

In the case of the South Napa earthquake, most of these customers may have benefitted from our Choice policy, which has a separate personal property deductible.