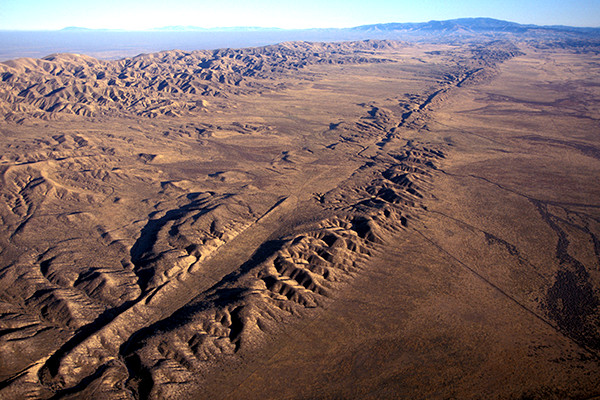

Section of the San Andreas fault system

The San Andreas fault system runs nearly the entire length of California, from south of the greater Los Angeles region to the San Francisco Bay Area and beyond. The famous 1906 San Francisco earthquake (M7.8) was caused by movement along the northern section of the fault, but the southern section hasn’t experienced a big shift since 1857, when a M7.9 earthquake ruptured near Los Angeles.

Since that time, the stress along the San Andreas has continued to build, increasing earthquake risk. There is now a greater than one in three chance that LA will see a M7.5 or greater earthquake in the next 30 years. The odds of a M6.7 quake, another Northridge, are nearly 2 out of 3.

Billions in Damage

The Northridge earthquake destroyed thousands of homes, displacing about 22,000 people and causing $20 billion in residential damage. A M7.8 quake along the San Andreas fault system would be 12 times bigger. According to the U.S. Geological Survey (USGS), such a quake would likely cause 1,800 deaths, 50,000 injuries and more than $200 billion in property damage.

About 3.5 million houses in the quake zone were built before stricter building codes were enacted in 1980. These houses will be particularly vulnerable to structural damage from strong shaking. (This is why CEA offers a premium discount to homeowners who retrofit houses that were built before 1980.)

How Would this Affect Your Insureds?

As seismologist Lucy Jones points out, the likelihood of dying in an earthquake, even a big one, is relatively low. But the odds of going bankrupt or suffering financial hardship after a big quake are not. This is one reason why it’s so important for your insureds to plan ahead.

Preparing now will help your insureds get through the coming earthquake with their health, family, and finances intact. And key to planning ahead is buying earthquake insurance, so that policyholders have the resources they need to repair and rebuild.

Earthquake Insurance Policies for Every Budget

Fortunately, CEA’s flexible earthquake insurance options make it easy for you to help your insureds find the plan that’s right for them, whether they want minimum catastrophic coverage, or prefer to cover every associated loss. And because we know that those first few days after a quake will be the hardest, CEA policies are designed to provide immediate relief to policyholders, with no deductibles for Loss of Use or the first $1,500 in emergency repairs coverage.

Earthquakes are inevitable, but financial strain doesn’t have to be. Use the CEA premium calculator to help your insureds find the policy that best suits their needs, and give them the peace of mind that comes with a CEA earthquake insurance policy.