Below are some of the most commonly asked questions—and answers—to help you explain to your clients how CEA deductibles work. We also arm you with the deductible calculator, which lets you run earthquake claim scenarios.

What are my client's deductible options?

All CEA policies offer deductibles of 5, 10, 15, 20, or 25 percent.

When does my client have to pay the deductible?

CEA policy deductibles are subtracted from the covered losses - your client will never have to pay the deductible out of pocket to receive a claim settlement.

How does one deductible relate to the others in a policy?

For standard Homeowners, covered dwelling and personal property damage is paid once the covered earthquake damage exceeds the Dwelling deductible. Homeowner Choice policies, on the other hand, have separate dwelling and personal property deductibles, but if the covered earthquake damage exceeds the Dwelling deductible, the Personal Property deductible would be waived.

Will my client get a claim payment if they carry a high deductible on their earthquake policies?

That depends on the type of coverage they have decided to carry on their policy. Remember that some coverages - such as the first $1,500 of emergency repairs on a homeowners policy and loss of use for all policies - are never subject to a deductible. With Homeowners Choice, Personal Property has its own deductible that is waived once the covered dwelling damage exceeds the dwelling deductible. This makes a Personal Property payment more likely after a moderate earthquake.

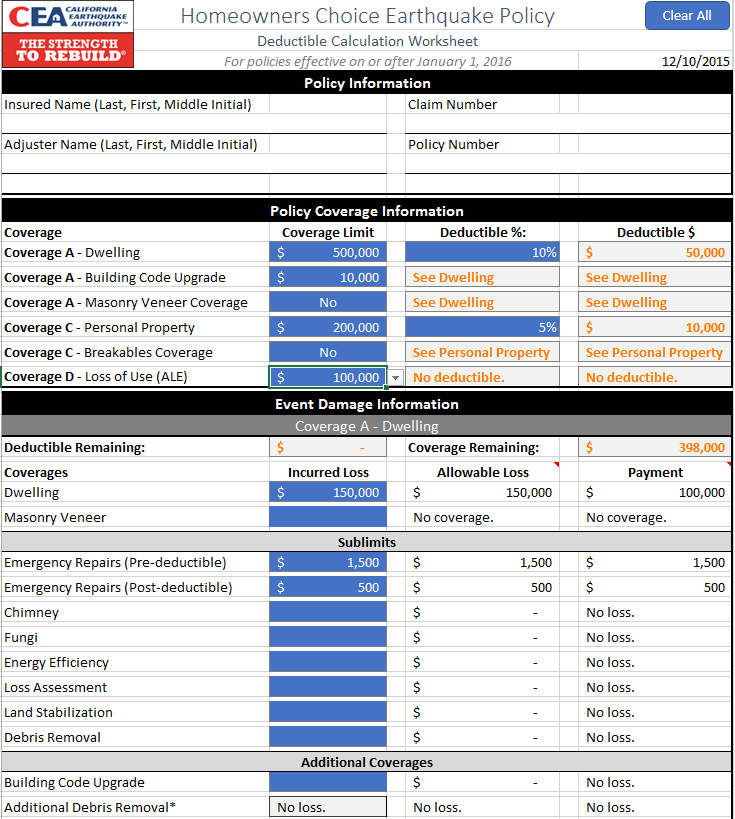

To help remove some of the mystery from deductibles, consider using the deductible calculator that allows you to run claim scenarios. This tool helps you give your clients a better idea of what a claim payment might look like in the event of an earthquake.